-

“TAX BLUEPRINTS” – Episode 22 – Maximizing Retirement Contributions: A Guide for Business Owners to SEPs, SIMPLEs, and 401(k)s

Welcome to this informative episode of Tax Blueprints, hosted by Daniel Rohr, a leading CPA […]

-

“TAX BLUEPRINTS” – Episode 21 – Maximizing Philanthropy & Minimizing Taxes: A Deep Dive into Donor-Advised Funds and Charitable Bunching

In this episode of Tax Blueprints, host Daniel Rohr, CPA and Personal Financial Specialist, unpacks […]

-

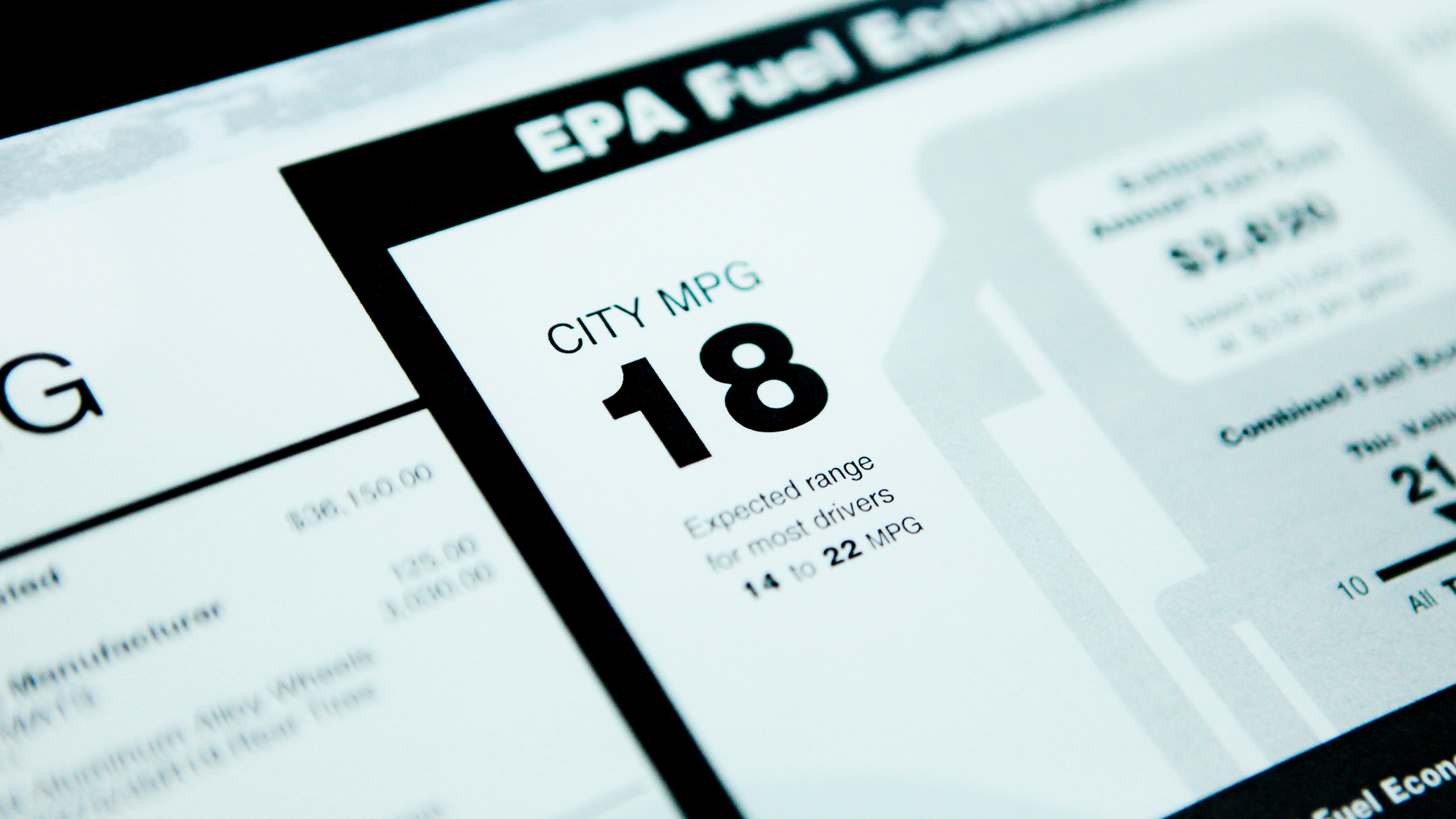

“TAX BLUEPRINTS” – Episode 20 – Auto Expense Deductions Unveiled: Maximizing Tax Savings for Business Owners

Welcome to another enriching episode of Tax Blueprints, hosted by Daniel Rohr, a veteran CPA […]

-

“TAX BLUEPRINTS” – Episode 19 – Navigating the Complex World of FBARs and Foreign Asset Reporting

Welcome to another informative episode of Tax Blueprints, hosted by Daniel Rohr, a seasoned CPA […]

-

“TAX BLUEPRINTS” – Episode 18 – Navigating the Maze of Business Entities – From Sole Proprietorships to Corporations

Join Daniel Rohr, CPA, Personal Financial Specialist, and Enrolled Agent, and the managing shareholder of […]

-

“TAX BLUEPRINTS” – Episode 17 – Unpacking the Power of Depreciation: Strategies to Maximize Your Tax Savings

Join Daniel Rohr, CPA, Personal Financial Specialist, and Enrolled Agent, as he breaks down the […]

-

“TAX BLUEPRINTS” – Episode 16 – Unlocking the Power of Educational Savings Accounts: A Deep Dive into 529s, Coverdells, Roths, and More

Welcome to another insightful episode of ‘Tax Blueprints’, hosted by Daniel Rohr, a distinguished CPA, […]

-

“TAX BLUEPRINTS” – Episode 15 – Securing Your Children’s Future With A Roth IRA

Welcome to another enlightening episode of Tax Blueprints, hosted by Daniel Rohr, a leading CPA, […]

-

S-Corp Educational Video Series – Video 1: Fundamentals

Navigating the landscape of business structures can be intricate and overwhelming. Recognizing the need for […]